6 Easy Facts About Hard Money Georgia Shown

Wiki Article

How Hard Money Georgia can Save You Time, Stress, and Money.

Table of ContentsNot known Factual Statements About Hard Money Georgia The 6-Second Trick For Hard Money GeorgiaGetting The Hard Money Georgia To WorkAn Unbiased View of Hard Money Georgia

The maximum acceptable LTV for a tough money lending is generally 65% to 75%. On a $200,000 residence, the optimum a hard cash loan provider would be prepared to lend you is $150,000.

By contrast, rate of interest rates on difficult cash finances begin at 6. Tough cash lending institutions often bill factors on your finance, in some cases referred to as origination charges.

Points are generally 2% to 3% of the loan quantity. 3 points on a $200,000 financing would be 3%, or $6,000.

The Basic Principles Of Hard Money Georgia

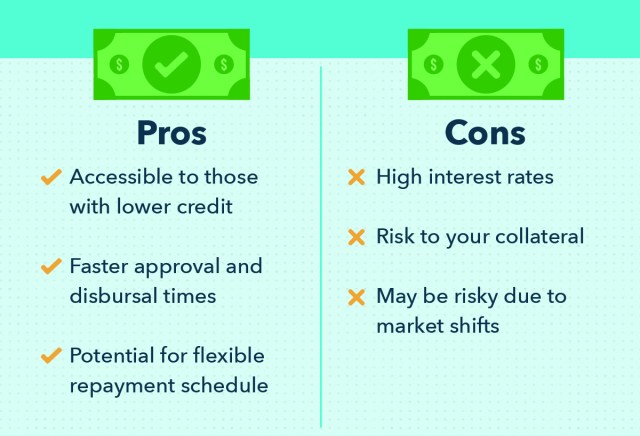

You can expect to pay anywhere from $500 to $2,500 in underwriting charges. Some hard money loan providers also charge early repayment charges, as they make their cash off the rate of interest costs you pay them. That suggests if you pay off the funding early, you might need to pay an added fee, adding to the lending's expense.This suggests you're more probable to be offered financing than if you used for a typical home mortgage with a suspicious or thin debt history. If you require money quickly for renovations to turn a residence for revenue, a hard cash financing can give you the cash you need without the trouble and documentation of a conventional home loan.

It's an approach investors make use of to buy financial investments such as rental homes without making use of a great deal of their own properties, and hard money can be beneficial in these scenarios. Hard cash finances can be useful for real estate financiers, they should be utilized with caution particularly if you're a beginner to actual estate investing.

With much shorter repayment terms, your monthly settlements will certainly be much more costly than with a regular mortgage. If you skip on your funding repayments with a hard money lending institution, the repercussions can be extreme. Some car loans are personally ensured so it can harm your credit. As well as since the finance is secured by the residential property concerned, the loan provider can occupy and seize on the residential property due to the fact learn the facts here now that it functions as collateral.

How Hard Money Georgia can Save You Time, Stress, and Money.

To find a credible lending institution, speak with trusted realty agents or mortgage brokers. They may have the ability to refer you to lenders they've dealt with in the past. Tough cash lending institutions also often go to investor conferences so that can be a great location to link with lenders near you.Equity is the value of the home minus what you still owe on the home loan. Like hard money lendings, home more info here equity car loans are secured financial debt, which indicates your residential or commercial property functions as collateral. Nevertheless, the underwriting for house equity financings additionally takes your credit rating and revenue right into account so they often tend to have lower interest rates as well as longer payment durations.

When it involves funding their following bargain, investor and also business owners are privy to a number of offering alternatives virtually created actual estate. Each features particular requirements to accessibility, and if utilized properly, can be of click here for more massive advantage to investors. Among these loaning kinds is difficult cash loaning.

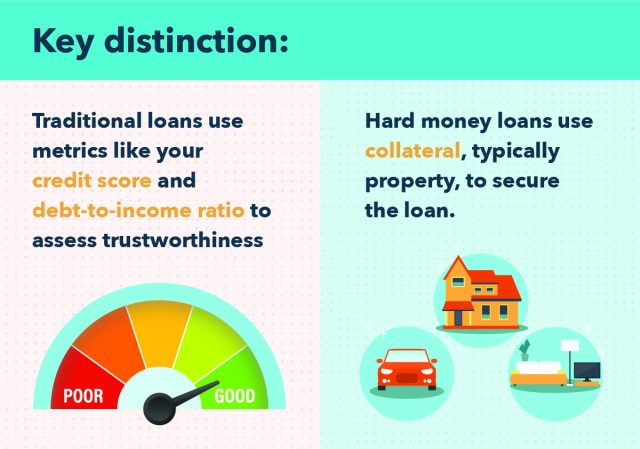

It can also be called an asset-based lending or a STABBL loan (short-term asset-backed swing loan) or a bridge lending. These are stemmed from its particular short-term nature as well as the need for substantial, physical collateral, generally in the type of actual estate building. A hard cash car loan is a car loan kind that is backed by or safeguarded making use of a real estate.

The Main Principles Of Hard Money Georgia

In the same vein, the non-conforming nature pays for the lending institutions a chance to choose their own details demands. Therefore, needs may vary dramatically from loan provider to lending institution. If you are looking for a lending for the very first time, the authorization procedure can be reasonably strict as well as you might be required to give additional information.

This is why they are generally accessed by genuine estate entrepreneurs that would commonly call for rapid funding in order to not lose out on hot possibilities. Additionally, the lender generally thinks about the value of the property or home to be bought instead than the borrower's personal money history such as credit report or earnings.

A standard or bank funding might take up to 45 days to shut while a tough money financing can be enclosed 7 to 10 days, often earlier. The benefit and also rate that tough cash fundings offer continue to be a major driving force for why investor select to use them.

Report this wiki page